Foreword: New Construction Projects, Promising Business Opportunities

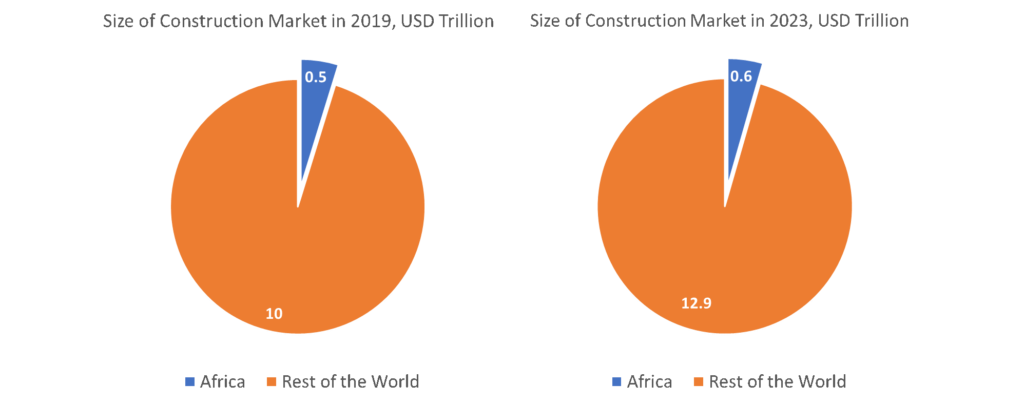

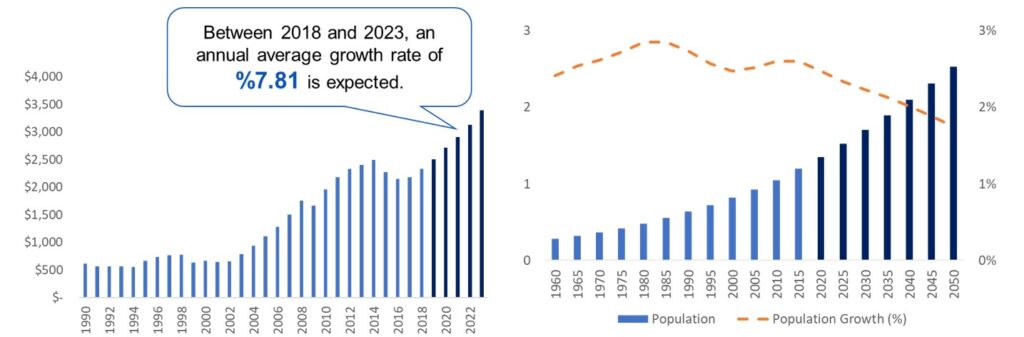

African countries have been heavily investing in construction projects, both infrastructure, and superstructure. The construction industry is one of the rapidly growing sectors in the continent and it greatly contributes to employment. Thanks to the population increase and urbanization in the continent, the strong growth of the construction sector is inevitable. However, there are still many crucial challenges to overcome: financing, available electrical grids, transportation, procurement, and skilled employees. In 2019, there was approximately US$500 billion investment to the 452 largest projects in Africa. The total size of the African construction market is approximately US$10 trillion a year. This amount is expected to increase to US$13 trillion in 2022.

There are many successful Turkish companies that secured tenders and completed projects in African countries. Yapı Merkezi is currently responsible for the construction of the Dar es Salaam-Morogoro-Makutupora Railway Line. Summa completed more than 5 projects in Senegal, including Dakar Arena, Dakar International Conference Center, and Blaise Diagne International Airport. In addition to large Turkish construction companies, there are many small and medium-sized construction companies that undertake residential and infrastructure projects.

There are many challenges that Turkish companies face in Africa. The most important challenge is the political and economic stability of host countries. The construction sector is greatly affected by the political and economic shifts. Most of the African countries are far from a stable political condition, and that endangers the future payment and completion of projects. Secondly, the local knowledge of Turkish companies in Africa is not strong yet. It an extra burden to source construction materials, employ local workers, and work with local administrative staff. As Turkish companies complete more projects in Africa, they will be more adapt to local factors and increase their competitiveness.

The demographic and economic trends in Africa offer very profitable opportunities for Turkish construction firms. The population of the African continent is increasing dramatically. Combined with the current underdevelopment, there is a huge need for infrastructure and housing for the masses. The current population of the continent is 1.35 billion and it is expected to reach 2.5 billion by 2050. Secondly, the economy is growing and many people move from the low-income level to the middle-income level. As a consequence of economic growth, there will be more demand for modern residential areas and office buildings. According to the latest estimates of the African Development Bank, Africa’s GDP could increase to over US$15 trillion in 2060, from US$2.6 trillion in 2019.

The aim of this report is to provide information about the potential and challenges of the construction sector in Africa. Turkish companies that are affected by the stagnated construction market in Turkey should look for opportunities abroad. Africa is a great market for Turkish construction companies thanks to the current underdevelopment level and increasing population. There are already successful cases of Turkish companies in the continent and there is still room for other companies to tap into new opportunities.

Top Construction Projects in Africa

North Africa

Hauts-Plateaux Motorway

Location: Algeria

Type of Project: Transportation

Budget: 8.94 Billion USD (Estimated)

Start/End Date: 30 October 2014-2025 (Expected)

Contractor: Chinese consortium: China International Trust and Investment Corporation (CITIC) and China Rail Construction Corporation (CRCC)

Project Information: Project is part of the master plan by 2025 in order to open up and link the cities in the highland areas of the interior, in parallel to the East-West Highway. The total length of the motorway is 1020km and connecting 44 provinces to motorways. The project is divided into ten sections. Each section, requiring 36 months of work, will be attributed to a different consortium of Algerian firms. If work begins on each section at the same time, the project could be completed in less than three years.

Egypt’s New Capital City

Location: Egypt

Type of Project: Real Estate

Budget: 58 Billion USD

Start/End Date: 2017-2022 (Expected)

Contractor: The China State Construction Engineering Corporation (CSCEC

Project Information: Egyptian government decided to move the capital city 35km east of Cairo due to the rapid increase in population. This project will transform the city into powerful economic growth hubs, due to its ability to offer people easier access to education, jobs, and other infrastructural facilities.

East Africa

Nairobi-Naivasha Rail Project

Location: Kenya

Type of Project: Transportation

Budget: 1.5 Billion USD

Start/End Date: 16 October 2019-2021 (Expected)

Contractor: China Communication Construction Company

Project Information: The project is part of the first phase of the Nairobi–Malaba Standard Gauge Railway Project which is a standard-gauge railway that connects Kenya’s capital city of Nairobi to Malaba, at the international border with Uganda. The Nairobi–Malaba SGR is expected to connect to other standard gauge railways in Uganda, Rwanda, Burundi, South Sudan, and the eastern Democratic Republic of the Congo, under the East African Railway Master Plan.

Konza Technology City

Location: Kenya

Type of Project: Real Estate

Budget: 14.5 Billion USD

Start/End Date: 2016 – 2023

Contractor: ICM, Huawei and Parklane Construction Ltd

Project Information: According to Kenya’s Vision 2030 national development plan, Konza will be a world-class city, powered by thriving information, communications, and technology (ICT) sector, superior reliable infrastructure, and business-friendly governance systems. The project is expected to be African silicon savannah where many technological, startup companies will be located.

West Africa

The Mambila Hydroelectric Power Project

Location: Nigeria

Type of Project: Energy & Power

Budget: 5.8 Billion USD

Start/End Date: February 2020-2030 (Expected)

Contractor: Joint venture between China Gezhouba Group (CGGC), Sinohydro and CGCOC (formerly CGC Overseas Construction)

Project Information: The Mambilla Hydroelectric Power Station is a 3,050 MW hydroelectric power project under development in Nigeria. When completed, it will be the largest power-generating installation in the country, and one of the largest hydroelectric power stations in Africa.

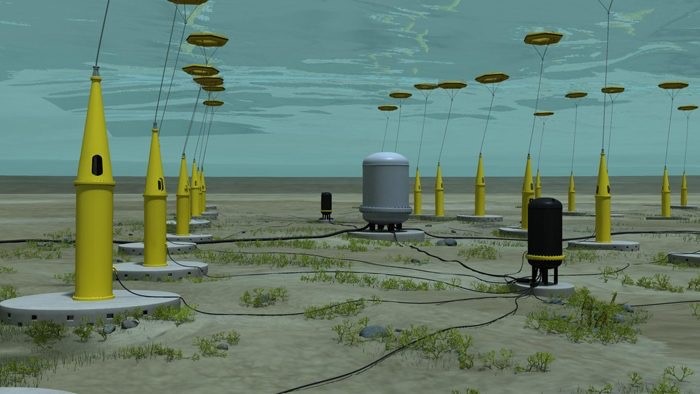

Ada Estuary Tidal Power Plant

Location: Ghana

Type of Project: Energy & Power

Budget: 2 Billion USD

Start/End Date: 2014-2016

Contractor: TC’s Energy USA and its partners, Power China Huadong Engineering Corporation Ltd and Seabased of Sweden

Project Information: The project seeks to establish a wave energy park in the Gulf of Guinea in Ghana, about 17 km off the coast of Ada to generate 1,000 megawatts (MW/H) of power from sea waves, employing an environmentally friendly technology – the ‘SEABASED’ Wave Energy Converters (WEC).

Southern Africa

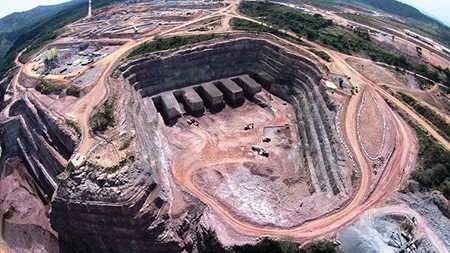

Lauca Hydropower Plant

Location: Angola

Type of Project: Energy & Power

Budget: 4.3 Billion USD

Start/End Date: 2012-2020

Contractor: Odebrecht

Project Information: The Lauca Hydroelectric Power Station is a 2,070 MW hydroelectric power plant. When completed, it will be the largest power station in the country. The power generated is integrated into the national electricity grid and supplies energy to approximately 8,000,000 customers in Angola. The project has provided over 8,000 direct jobs during the construction phase.

Coral South Floating LNG Facility

Location: Mozambique

Type of Project: Oil & Gas

Budget: 4.6 Billion USD

Start/End Date: 2022-2024

Contractor: TechnipFMC, JGC Corporation and Samsung Heavy Industries

Project Information: The Mozambique LNG Project started with the discovery of a vast quantity of natural gas off the coast of northern Mozambique in 2010, leading to a $20 billion Final Investment Decision in 2019. Now, through cooperation and responsible project planning, the project is on track to deliver LNG in 2024. The Project is operated by Total – the world’s second-largest LNG player with a leading presence in Africa which is uniquely qualified to ensure the Mozambique LNG Project helps to meet the world’s increasing demand for sustainable, reliable, and cleaner energy sources.

Central Africa

Lom Pangar Dam and Hydropower Project

Location: Cameroon

Type of Project: Energy & Power

Budget: 0.5 Billion USD

Start/End Date: 2012-2017

Contractor: China International Water & Electric Corporation

Project Information: The development objective of the Lom Pangar Hydropower Project is to increase hydropower generation capacity and reduce seasonal variability of water flow in the Sanaga River and to increase access to electricity.

Country Analysis

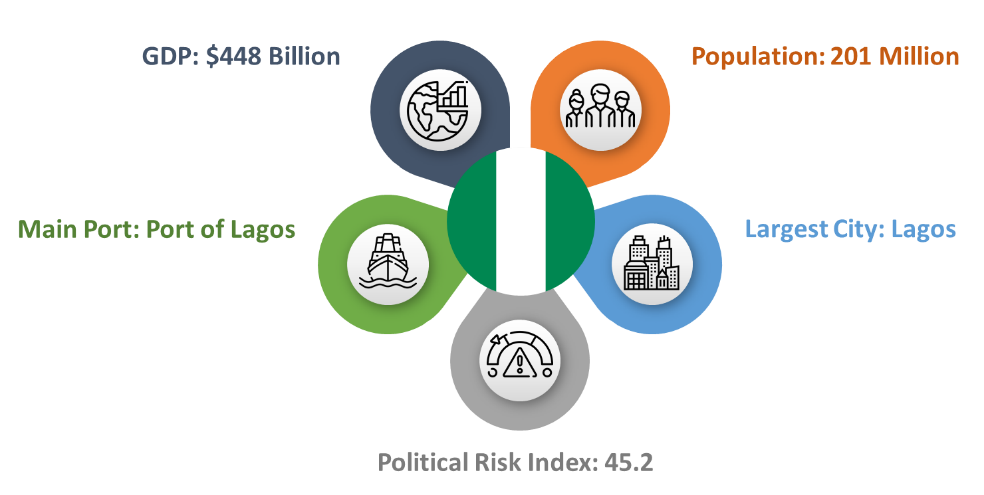

Nigeria

The Federal Republic of Nigeria is located in West Africa. It is bordered by Cameroon, Niger, Chad, and Benin. Nigeria is referred to as the `Giant of Africa’, due to its strong economy and large population. Its population reached 191 million in 2018 and Nigeria has the highest GDP in Africa with $375 Billion. Nigeria overtook South Africa in 2014 to become Africa’s largest economy. Nigeria is a member of the African Union, United Nations, OPEC, and Commonwealth.

Turkey and Nigeria have diplomatic relations since the independence of Nigeria. Turkey opened an Embassy in Lagos, the previous capital of Nigeria, in August 1962. Turkish businesses can find important opportunities in Nigeria thanks to its large and diversified economy. Manufacturing and food companies can use Nigeria as a hub to expand to other West African countries. The exports of Turkey to Nigeria are concentrated in industrial goods and agricultural products. Especially, processed iron is important to export goods from Turkey to Nigeria.

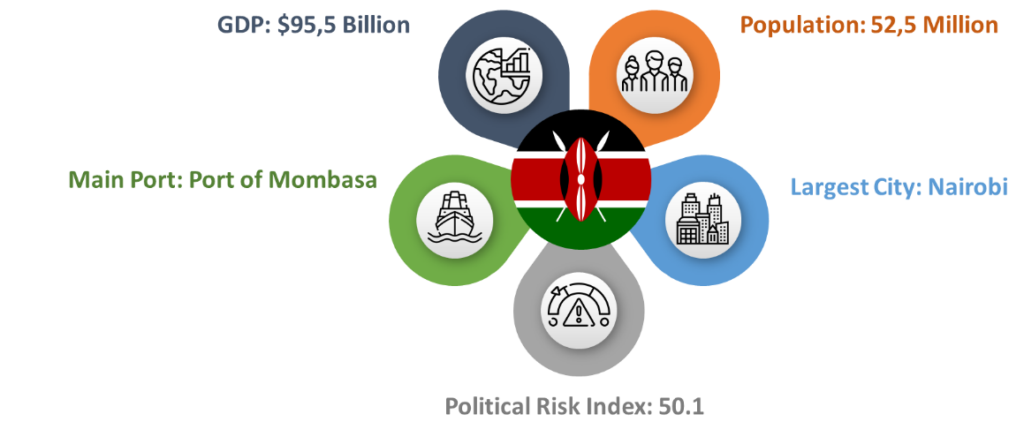

Kenya

Kenya is located in East Africa and it is bordered by Ethiopia, Somalia, South Sudan, Uganda, and Tanzania. Kenya’s population is 50 million and its GDP is $74 Billion. Kenya is a member of the United Nations, World Bank, International Monetary Fund, COMESA, East African Community trade bloc, and other international organizations.

The commercial relations between Kenya and Turkey have increased significantly in the last 10 years. Total exports increased from $130 Billion to $190 Billion between 2008 and 2017. Fertilizers are the main export product of Turkey to Kenya with 26% of total exports in 2017. Kenya is an important market for Turkish companies that are willing to enter the East African market. It has one of the largest shipping ports and land connections to other major markets such as Uganda.

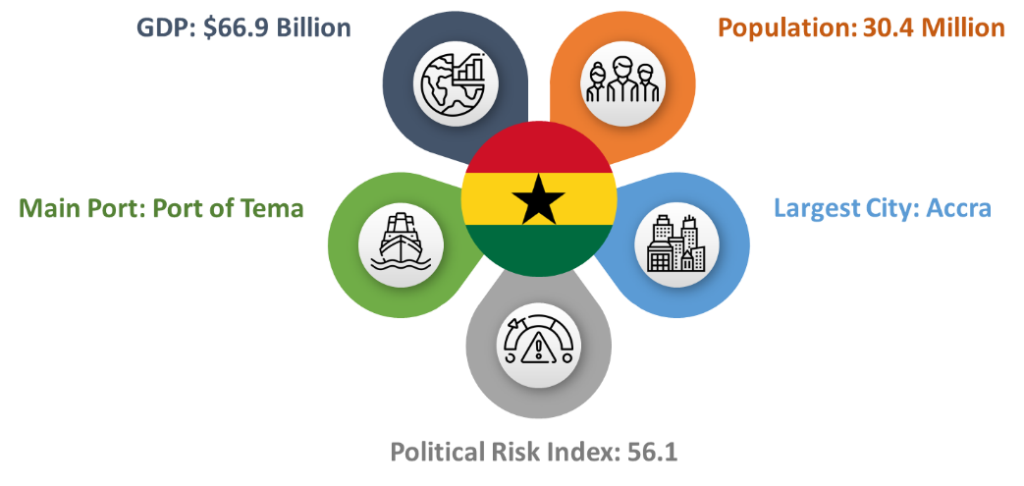

Ghana

The Republic of Ghana is located in West Africa and it is bordered by Ivory Coast, Burkina Faso, and Togo. Ghana’s population is 29 million and its GDP is $47 Billion. Ghana is a member state of the Non-Aligned Movement, the African Union, the Economic Community of West African States (ECOWAS), Group of 24, and the Commonwealth of Nations.

The first Turkish Embassy in Accra was opened in 1964. Turkish foreign direct investment in Ghana is around $500 Million and it is expected to increase with new trade agreements. Turkish businessmen visit Ghana on many occasions to explore opportunities. Turkish construction companies have ongoing projects in Ghana such as Kotoka International Airport. Turkish importers can benefit from the cocoa business in Ghana.

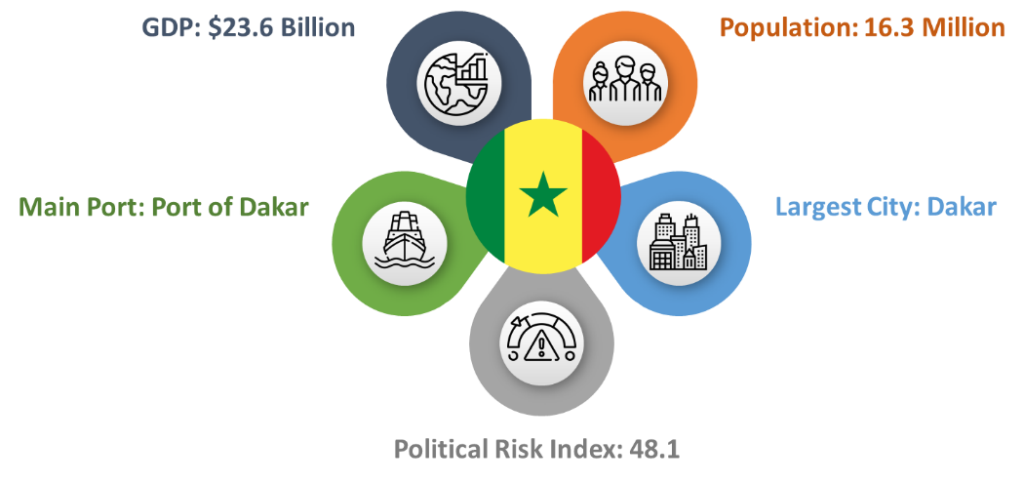

Senegal

The Republic of Senegal is located in West Africa and it is bordered by Mali, Guinea, Guinea-Bissau, Gambia, and Mauritania. The population of Senegal is 16 million and its GDP is $16 Billion. Senegal gained independence from France in 1960. French is the official language. Its capital city is Dakar with a population of around 1 million people.

Turkey and Senegal have close commercial relations in the last decade. The exports to Senegal increased from $108 Million to $257 Million in the last 10 years. The development of bilateral relations agreement was signed between Turkey and Senegal in December 2017. Many Turkish construction companies have ongoing activities in Senegal. For example, Yapı Merkezi was the contractor of a €373 Million high-speed train project in Senegal. Finally, due to the development of relations, the General Manager of Turkish Eximbank was given the State Order of Senegal.

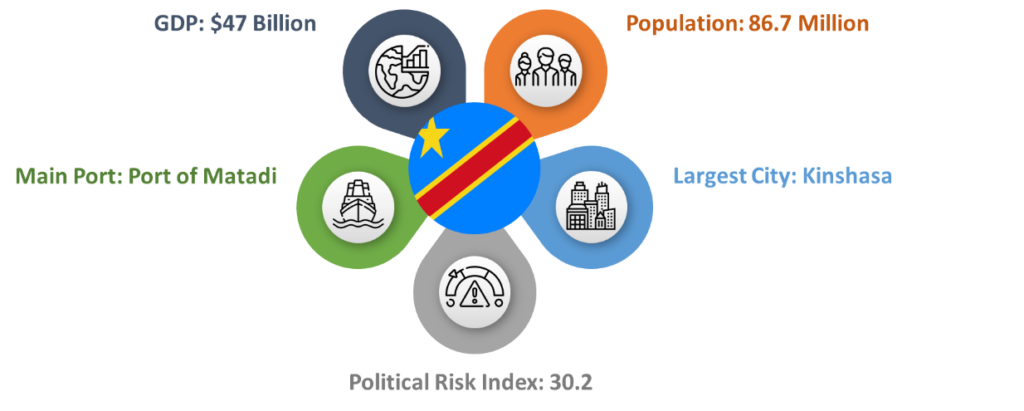

Democratic Republic of Congo

The Democratic Republic of the Congo is located in Central Africa and it is bordered by the Republic of Congo, Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia, and Angola. Congo’s population is 82 million and its GDP is $37 Billion. Congo is a member state of the United Nations, Non-Aligned Movement, African Union, and COMESA.

The first Turkish Embassy in Kinshasa opened in 1974 and Congo opened its embassy in Ankara in 2011. Turkish exports to Congo increased significantly in the last 10 years from $9 Million to $27 Million. The exports are concentrated in the food sector, including chicken meat, pasta, and yeast. Since Congo imports, most of its food, companies in the food sector can focus on exporting to Congo.

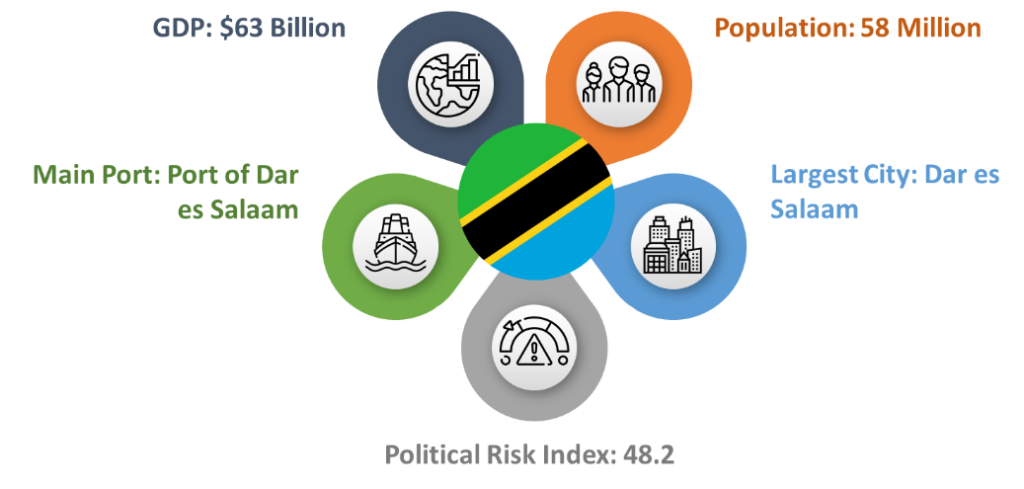

Tanzania

The United Republic of Tanzania is located in East Africa and it is bordered by Uganda, Kenya, Mozambique, Malawi, Zambia, Rwanda, Burundi, and the Democratic Republic of Congo. Tanzania’s population is 58 million and its GDP is $42 Billion.

The first Turkish Embassy in Dar es Salaam was first opened in 1979. There have been Turkish Airlines direct flights between Istanbul and Dar es Salaam since 2010 and it impacted the relations between Turkey and Tanzania. Turkish businessmen visit Tanzania on many occasions to explore opportunities. In 2018, agricultural machine companies attended a forum in Dar es Salaam to establish new connections. Turkey’s exports to Tanzania reached $100 Million in 2017. The agriculture and construction sectors are the main areas to be focused on.

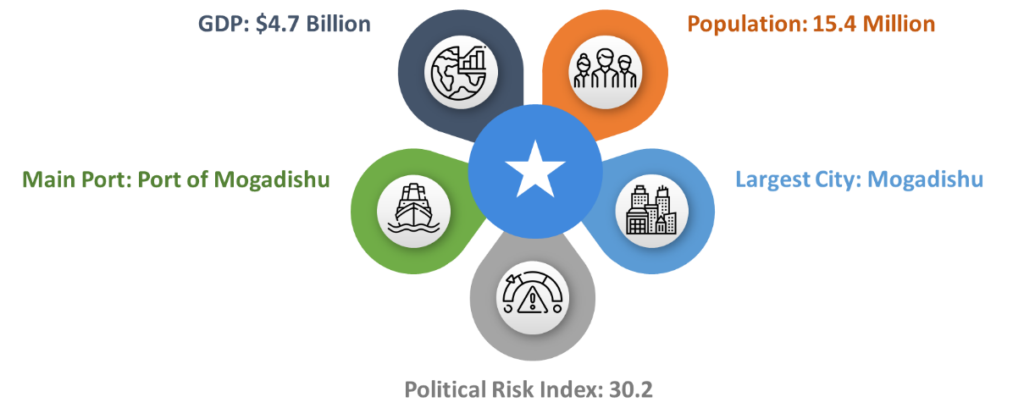

Somalia

The Federal Republic of Somalia is located in the Horn of Africa. It is bordered by Ethiopia, Djibouti, and Kenya. Somalia’s population is 15 million and its GDP is $4,7 Billion. Bordered by the Gulf of Aden and the Indian Ocean, Somalia has a vast coastal exposure which represents strong potential for its trade and economy. Despite the pandemic, GDP growth is projected at 3.2% in 2020 and 3.5% in 2021. An improving security situation, normalization of relations with international financial institutions, and prospects of debt relief present opportunities to address economic and social challenges. Somalia is an African country with the greatest infrastructure needs.

Turkey’s economic and diplomatic relations with Somalia date back to the Ottoman Empire. In May 2013, the first Turkish-Somali Business Forum was launched in Istanbul to highlight commercial opportunities in both Somalia and Turkey for Somali and Turkish businesses. Turkey’s bilateral trade volume with Somalia was $250.8 million in 2019. The total value of Turkish investments in Somalia has reached $100 million US Dollars. Construction and Infrastructure investments are growing, with Turkish companies running Mogadishu International Airport and Mogadishu Sea Port.

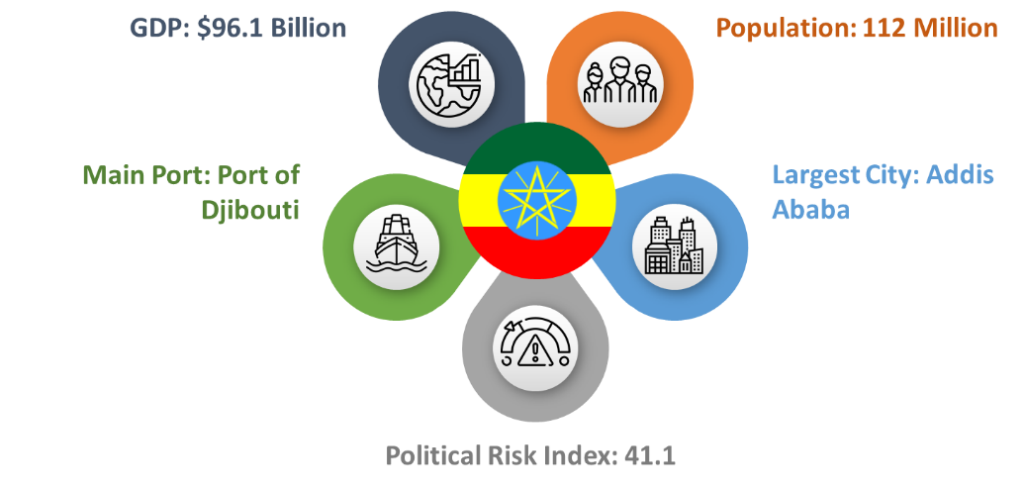

Ethiopia

The Federal Democratic Republic of Ethiopia is located in North-East Africa and it is bordered by Eritrea, Djibouti, Somalia, Sudan, South Sudan, and Kenya. Ethiopia’s population is 105 million and its GDP is $81 Billion. Ethiopia is the headquarter of the African Union, the Pan African Chamber of Commerce and Industry, the United Nations Economic Commission for Africa, the African Standby Force, and many of the global NGOs focused on Africa.

Turkey and Ethiopia have close economic relations. Most of the Turkish foreign direct investment is in the textiles sector and there are further efforts to increase Turkish investment in Ethiopia. Turkish companies invested more than $2.5 Billion in the country. The construction sector and construction products play an important role in Turkish exports. Raw iron bars had a 24% share in total exports in 2017.

Angola

Located in South-Central Africa, Angola is bordered by Namibia, the Democratic Republic of Congo, and Zambia. It has a population of 30 million people and its economic output is $124 Billion. Angola has vast mineral and petroleum reserves, which increases the growth rate of its economy. Angola is a member of the United Nations, OPEC, African Union, the Community of Portuguese Language Countries, and the Southern African Development Community.

Turkey and Angola established diplomatic relations in 1980. Turkey’s exports to Angola concentrate on the food sector, such as pasta, wheat flour, yeast, and poultry meat. Angola imports almost 50% of its food from foreign countries, and we advise our clients to focus on food products. In 2017, the 1st Session of the Joint Commission on Trade, Economic and Technical Cooperation between Angola and Turkey took place in the Angolan capital. Turkey was represented by the Minister of Customs and Trade, Bulent Tufenkci.

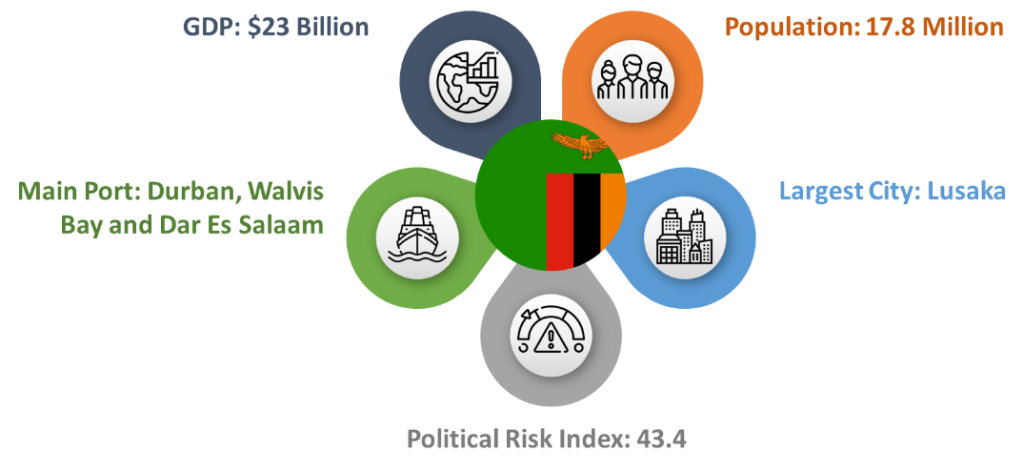

Zambia

The Republic of Zambia is located in South-Central Africa and it is bordered by the Democratic Republic of Congo, Malawi, Mozambique, Zimbabwe, Botswana, and Tanzania. The population of Zambia is 17 million and its GDP is $25 Billion. Zambia gained independence from the United Kingdom in 1964 and the current constitution is effective since 2016. English is the official language. Its capital city is Lusaka with a population of around 2 million people. The headquarter of Common Market for Eastern and Southern Africa (COMESA) is located in Lusaka.

Turkish Embassy in Zambia was opened very recently in 2011. Before the opening of the embassy, Turkish embassies in Nairobi and Pretoria are accredited to Zambia. DEIK and the Turkish Exporters’ Assembly are working closely with Zambian authorities to promote trade and investment between the two countries. According to our research, the construction sector has been developing rapidly in Zambia. Building and construction is the largest sector of Zambia comprising around 25% of the GDP and its growth rate is more than 10% each year. We advise Turkish companies to look for opportunities in contracting and construction materials.

Case Study of Successful Turkish Companies in Africa

Turkish construction companies involved many small to megaprojects across 31 countries in different industries such as below:

- Commercial Construction

- Residential Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utilities Construction

Turkish companies improved their local experience and knowledge of the countries’ market by involving projects and eventually bringing their investors to finance their projects in Africa. At each project done in Africa learning has improved for organizations. Now Turkish companies are operating in most of the countries in Africa even the landlocked countries. By bringing the Turkish expertise and quality of construction, stakeholder support is achieved at all levels from local society to the government. Some of the Turkish construction companies are below which have undertaken many construction projects in Africa.

Summa International Construction Co. Inc

Company Info: Summa carries out top-quality operations in 14 countries in various sectors ranging from construction to energy with 2500 employees on 4 continents across the globe.

Number of Countries Operating in Africa: 8

Countries: Libya, Senegal, Niger, Benin, Equatorıal Guinea, Republic of Congo, Rwanda. Swaziland

Type of Projects: International Airport, Hotel, Conference & Congress& Expo Center, Residential Complex, Mall, Government Buildings, Sports Arena.

Dorçe Prefabricated Building And Construction Industry Trade Inc.

Company Info: Dorce Inc. provides Engineering, Procurement and Construction (EPC) services for projects requiring high-quality services in extreme environments and undertakes the following General Contracting Projects for Construction and EPC Services to the clients in Oil, Gas and Energy Industry, Mining Industry, Construction Industry, Governmental Authorities (Ministries, Governorates, Embassies, etc.), Militaries, International and non-profit Organizations, etc. all around the World.

Number of Countries Operating in Africa: 11

Countries: Mauritania, Guinea, Mozambique, Gabon, Sudan, Algeria, Congo, Djibouti, Libya, Niger, Nigeria

Type of Projects: Housing and Residences, Hospitals and Clinics, Industrial Facilities, Business Centers, Shopping Malls, Aircraft Hangars, Sporting Halls, Military Camps

Construction Tender Process

The infrastructure deficit in Africa, estimated at $70 billion every year according to World Bank data, is at the origin of strong demand and a paradox: the financial resources available for infrastructure are largely surplus to the annual need of developed projects. Infrastructure investment in Africa surpassed the $100 billion mark for the first time in 2018 and a large share of potential funding remains unallocated. With a dynamic African construction and infrastructure sector, there are many financing possibilities for projects carried out by companies and private investors. This particular conjuncture is therefore an opportunity for companies able to offer projects with solid returns and risk mitigation. Although some investors provide financial support at the development stage, a strong business plan is required to receive funds from banks and investors.

Furthermore, given the high demand for sustainable infrastructure in Africa, the social and environmental orientation of the project can help to attract larger volumes of financing, especially from development institutions and impact investors.

There are different statuses for a construction company on a project. Either the company responds to tender, in which case it is not responsible for financing the full amount of the project, or the company is the instigator and stakeholder in the financing of the project.

The following paragraphs will explain the different means and players involved in financing the infrastructure projects :

Within the framework of concession or Public-Private Partnership, there are several models of project finance adapted to the specificities of each project.

In the Build-Own-Operate models, BOO, the company finances the project and owns the infrastructure. The revenues of the projects are provided by the users or by the state. The Build-Own-Operate-Transfer model, BOOT, is similar to the BOO system with a slight difference in the final transfer of the infrastructure to the government.

In the Build-Transfer, BT, model, the company designs, finances, and builds the project and then transfers ownership to the government.

In BOO, BOOT and BT, financing is generally based on 20 to 35% equity and 65% to 80% debt provided by a mix of public and private investors which are explained in the next section.

Project and Construction Finance

Governments

The main funders for African infrastructure are African governments. In 2018, they accounted for 37.5% of funds invested in infrastructure development, an increase of 3% over the previous five years. The cancellation of the debt of some African countries could considerably increase their investment capacity in infrastructure. The participation of governments, which invest in PPPs, offers guarantees to access development banks and private funds. African governments participate mainly in the financing of transport projects, which accounted for 55.3% of government-funded projects, and energy projects, for 20.4%.

Development Banks and Funds

Bilateral, multilateral, or national development banks and agencies fund a sizeable of investments in Africa. The construction and infrastructure sector is a target investment sector for institutions whose objective is to support economic, social, and sustainable development. They have multiple financial tools at their disposal to participate in the financing of infrastructure projects and generally offer loans, equity, and guarantees. For example, Proparco, the private sector arm of the French Development Agency, offers the following services:

- Short and long maturities loans

- Equity and quasi-equity

- Solvability and liquidity guarantees

- Financing in local currency

Development banks sometimes also provide early-stage funds to fine-tune the project’s design prior to a larger fundraising campaign.

Moreover, development banks are a significant quality label for accessing other sources of financing. For instance, the African Development Bank connects public and private investors through its Africa50 Infrastructure Fund.

Development banks often provide advisory services. They can assist companies in their search for private funds, and provide expertise in project finance and PPPs. They assist companies to improve their operational performance and sustainability and adopt good practices and standards to increase competitiveness and productivity. In the construction sector, IFC offers tools and training to construct buildings that use energy, water, and materials more efficiently.

Principal development banks that finance projects in Africa are listed below:

- IFC

- Africa Development Bank

- European Investment Bank

- Islamic Development Bank

- Proparco

Institutional Investors

Institutional investors are playing an increasing role in infrastructure financing in Africa. Indeed, in the context of low-interest rates on sovereign bonds, infrastructure debt is a safe haven. Hence, institutional investors are becoming more and more important in the debt financing of infrastructure in Africa, offering stable yields in a long-term, social-oriented perspective that meets institutional investors’ objectives. Infrastructure debt has become a proper asset class for pension funds, insurance companies, and sovereign wealth funds. They now represent a very significant amount of potential finance for infrastructure in Africa.

Social infrastructures such as schools, hospitals, cultural and sports facilities, and other public buildings or transport projects, are particularly targeted by institutional investors.

Commercial Banks

Aside from development banks, commercial banks are the first providers of debt for project finance. They either issue loans or assist companies in bond or Sukuk issuance. In both cases, they propose tailor-made debt solutions. As a capital-intensive sector, Infrastructure financing requires a high level of debt, representing generally between 70% and 90% of the total capitalization of a project.

Commercial banks can issue long-term maturities loans, most times in local currency to avoid currency mismatch between project financing and revenue flows. Depending on the size of the project, direct, co-investment, or syndicated loans are issued.

Banks also guide companies in issuing bonds. These can be traditional bonds, green bonds, or project bonds. Green bonds are recent financial tools that are an interesting option for projects designed to meet ESG criteria. Project Bonds are also a recent and growing trend in infrastructure finance. They are ideal to provide long-term funding for large projects (over $100 million). Sukuk are issued as part of financing by an Islamic bank. It is a debt instrument similar to bonds, which is based on real assets and does not involve the payment of interest.

Most international commercial banks offer infrastructure debt services, and the most active international banks in project finance in Africa are the following:

- Societe Generale CIB

- BNP Paribas CIB

- SMBC Bank International

Exim Banks

Import Export banks and credit agencies offer to finance and guarantee solutions adapted to international projects involving imported resources and materials. The offer differs according to the banks. In the field of credit, Türk Exim Bank mainly offers buyer loans to finance the import of Turkish goods. Türk Eximbank does not finance an entire project but can finance up to 85% of the materials and equipment imported from Turkey. Such financing can be advantageous when the importable materials represent an important part of the construction budget. Among the financing granted by Turk Eximbank, 14% concerned projects in Sub-Saharan Africa. Loans limits depend on the risk profile of the country where the project is conducted.

Moreover, other Exim banks offer direct project financing solutions. This is notably the case of Afreximbank, the African export credit agency, which offers loans of up to seven years for construction and infrastructure projects.

Turk Eximbank and Afreximbank also provide a wide range of guarantee products, including export credit guarantees, sureties, and short, medium, and long-term guarantees which are key factors of risk mitigation.

Infrastructure Funds

Recent players in infrastructure financing, specialized private equity funds are taking increasing stakes in the capital of infrastructure projects. These funds provide a share of the 20-30% of the equity required to contract large volumes of debt. Infrastructure funds can invest capital at different stages of the project, from venture capital to refinancing. This class of financing is experiencing strong growth, (statistics). In the context of lack of infrastructure on the continent, the trend is towards increased private investment as institutional players seek to attract private equity funds to infrastructure investment.

Funds that specialize in the African infrastructure market:

- Meridiam

- Emerging Africa Infrastructure fund

- InfraCo Africa

- ARM-Harith

- Vantage Capital

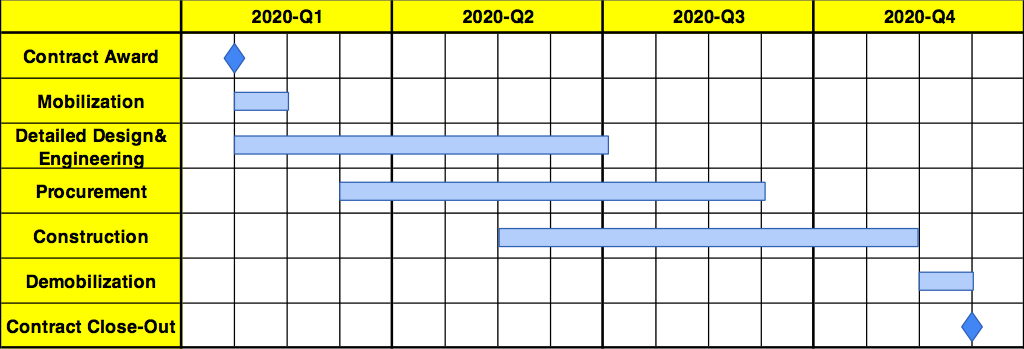

Project Management

The management of construction requires state-of-art project management knowledge aiming for completion of project objectives such as time, cost, scope, quality, stakeholder satisfaction, etc. A typical high-level construction schedule can be seen below.

Contract Award

The project is officially started with a mutually signed contract. At the tendering stage, the contractor provided preliminary documents for schedule, budget, procurement, execution plans, etc. After the kickoff meeting contractor will need to prepare detailed plans, work procedures, baselines for the successful execution of the project.

Main Tasks

- Commercial negotiations

- Contract clarifications

- Complying local regulations

- A detailed project execution plan

- Detailed cash flow preparation

Mobilization

The contractor’s site establishments such as temporary office containers, prefabricated accommodations, etc begin right after the contract award. The contractor will need to mobilize as quickly as possible to start the execution of the project. Personnel recruitment or relocation from different projects and heavy equipment purchasing and leasing start at this phase.

Main Tasks

- Local company establishments

- Site office establishments

- Qualified subcontractor agreements

- Local technical personnel recruitment

- Work permit procedures for personnel

- Logistics planning

Detailed Design & Engineering

Design and engineering start concurrently right after the contract award. This phase is very important in order for a high-quality design which is conforming to client design specifications. Technical disciplines work together with electrical, civil, mechanical, piping, instrumentation, etc to produce the project deliverables. Drawings are generated, checked, and executed within approval cycles.

Main Tasks

- Design codes, standards, calculations

- Approval of drawings

- Value engineering

- Material take off planning

- Equipment size calculation

Procurement

The construction procurement phase starts with material take-offs form from engineering or architectural drawings. From consumables to long lead items commercial and technical negotiations with vendors are executed before procurement. For timely available materials on-site, buyer, expediting and inspection teams coordinate the procurement process to minimize duration for logistics.

Main Tasks

- Long lead items

- Inspection

- Local Qualified Vendor Lists

- Procurement Logistics Route

- Expediting

Construction

The execution of the contractual work is done at this phase. The aim is to stay within budget, time, and conform to the quality standards. Most of the budget is spent at this phase, therefore multiple controlling mechanisms are set to track the progress on-site and report to the client.

Scope of work in the contract is checked throughout the contract to execute the full work in the contract.

Main Tasks

- Management of change

- Management of risk

- Cash flow management

- Balancing manpower on site

- Client-Contractor communications

- Collection of acceptance signoffs

Demobilization

This phase includes removal of Contractor’s, Subcontractor’s equipment, container, site establishments, materials, personnel, temporary facilities.

Main Tasks

- Equipment leasing checks

- Subcontractor materials, equipment, personnel

- Environmental checks

- Checklist checking

- Compliance in the contract

Contract Close-Out

When the contractor’s contractual obligations are completed and work is finished, the close-out phase starts. While the documents are reviewed and audited for any remaining items.

Main Tasks

- Collection of remaining payments

- Checking Bond Letter

- Collection of signoffs

Our Services in Africa

We offer full project management services or partial services listed below with information.

Project Management

We have project management experience of small size project to mega-size construction projects. Our extensive experience can enable projects to finish on time and preventing cost overruns by approaching the project holistically. We coordinate the meetings with project Contractors and Consultants aligned with the Client requirements. Starting from contract award to close out of the project we use our extensive value creation and cost reduction methodologies.

Schedule & Cost Management

To complete the project on time and within budget, progress needs to be controlled with different project control mechanisms. We can create baselines, track, and update the project schedule on Primavera P6 or Microsoft Project depend on the Client requirements. We can provide detailed Cost Reports to track the remaining budget and to manage cash flow. Our Cost Reduction expertise will be given at each phase of the project to increase profits.

Contract & Procurement Management

From preparing the technical and commercial proposals, we know what the client expects. To analyze the estimated project manhours, we benchmark from similar projects to near the expected Client figures. For timely available material or equipment on-site, we use our extensive list of the vendor from multiple locations and countries to seek for best price and quality.

Change & Risk Management

At the beginning of every project, the risk is considered high. Design changes have a significant effect on construction which could lead to cost overrun. We have change and risk management experience to decrease the number of changes and risks for the whole construction period.

Final Notes

African countries offer important economic opportunities for Turkish construction companies who are willing to increase their revenues profitably. The construction sector in Africa is developing faster than other continents, and there are many mega-projects to be completed soon. The projects in each country should be evaluated carefully and Turkish companies should target the right countries where they can leverage their existing business acumen.

There are potential revenues and risks of doing construction projects in African countries. The macroeconomic factors and sectoral trends should be carefully watched during the project completion. The construction companies should work with professional business and legal advisors during the tender process. The contracts have to be carefully reviewed in case something goes wrong in the future. If the projects are financed by local governments, the financial solvency of that government is very important for the fulfillment of future payments. It is crucial to work with financial advisors that give insights about the solvency and financial indicators.

Financing is an important element of construction projects. There are many financing options for Turkish construction companies. They can self-finance their projects if they have enough assets. Alternatively, they can apply to Turk Eximbank to receive low-interest loans. Finally, they can approach international development organizations, such as IFC, EBRC, and Africa Development Bank to finance their projects. The share of Sub-Saharan Africa in the Turk Eximbank portfolio is 14%. Other development banks also focus on Sub-Saharan Africa infrastructure projects and they grant more funds.

Project Management is more complicated in Africa compared to the other regions of the world. Especially the procurement of building materials and human resources is problematic. To solve these problems, Turkish construction companies can consider working with a local partner or mobilizing their human resource onsite from Turkey. The companies that can overcome long lead times and poor quality of materials will have an advantage over their competitors.

As Istanbul Africa Trade Company, we offer full project management services or partial services for construction companies that are willing to undertake projects in Africa:

- Project Management

- Schedule & Cost Management

- Contract & Procurement Management

- Change & Risk Management

Authors

Burak Unal - Director of African Markets

Burak Unal is the founder and the Director of African Markets and Relations of Istanbul Africa Trade Company. In this role, he is responsible for leading the company’s global trade initiatives and client relations. Burak is responsible for managing relations with national business councils and businessmen.

Gürkan Çaylak - Manager of Business Development

Gürkan Çaylak is the Director of Business Development at Istanbul Africa Trade Company. He is responsible for providing advisory services to Turkish Construction and Oil&Gas companies that are willing to operate in Africa. He manages the tender processes, loan application and construction management.

Dala Koïta - Business Development Specialist

Dala Koïta is working as a Business Development Specialist at Istanbul Africa Trade Company. In this role, she is responsible for conducting research, creating quantitative models, preparing presentations and communicating with clients.